BUILDING A SOLIDINVESTMENTSTRATEGY

Our “Word of the Day” this week was

diversification. To recap, diversification is defined as spreading out risk by putting money into a variety of investments that are not subject to the same risks, such as stocks, bonds, ETFs, mutual funds, cash, and commodities.

The goal of diversification is not necessarily to boost performance because it doesn’t ensure gains or guarantee against losses. Diversification does, however, have the potential to improve returns for whatever level of risk you choose to target. To build a diversified portfolio, you should look for investments such as: stocks, bonds, cash, or others whose returns haven't historically moved in the same direction and to the same degree. This way, even if a portion of your portfolio is declining, the rest of your portfolio is more likely to be growing, or at least not declining as much.

Another important aspect of building a well-diversified portfolio is trying to stay diversified within each type of investment. Within your individual stock holdings, beware of over concentration in a single investment. For example, you may not want one stock to make up more than 5% of your stock portfolio. It’s smart to diversify across stocks by market capitalization (small, mid, and large caps), sectors, and geography. Again, not all caps, sectors, and regions have prospered at the same time, or to the same degree, so you may be able to reduce portfolio risk by spreading your assets across different parts of the stock market. You may want to consider a mix of styles too, such as growth and value.

When it comes to your bond investments, consider varying maturities, credit qualities, and durations, which measure sensitivity to interest-rate changes.

Key takeaways

• Diversification can help manage risk.

• You may avoid costly mistakes by adopting a risk level you can live with.

• Rebalancing is a key to maintaining risk levels over time.

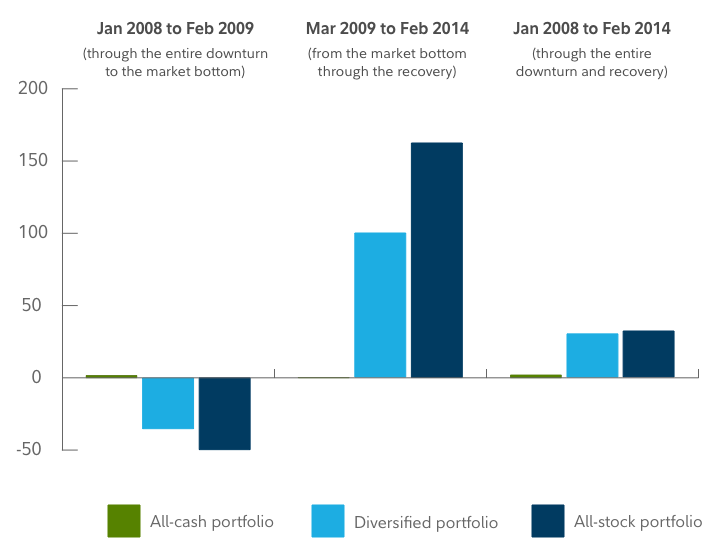

During the 2008–2009 bear market, many different types of investments lost value at the same time, but diversification still helped contain overall portfolio losses.

Consider the performance of 3 hypothetical portfolios: a diversified portfolio of 70% stocks, 25% bonds, and 5% short-term investments; an

all-stock portfolio; and an

all-cash portfolio. As you can see in the table below,

a diversified portfolio lost less than an all-stock portfolio in the downturn, and while it trailed in the subsequent recovery, it easily outpaced cash and captured much of the market's gains. A diversified approach helped to manage risk, while maintaining exposure to market growth.

**Past performance is no guarantee of future results**

Why is it so important to have a risk level you can live with? The value of a diversified portfolio usually manifests itself over time. Unfortunately, many investors struggle to fully realize the benefits of their investment strategy because in tough markets, people tend to chase performance and purchase higher-risk investments; and in a market downturn, they tend to flock to lower-risk investment options; behaviors which can lead to missed opportunities. The degree of under-performance by individual investors has often been the worst during bear markets. It’s important to learn how to become a disciplined investor.Building a diversified portfolio

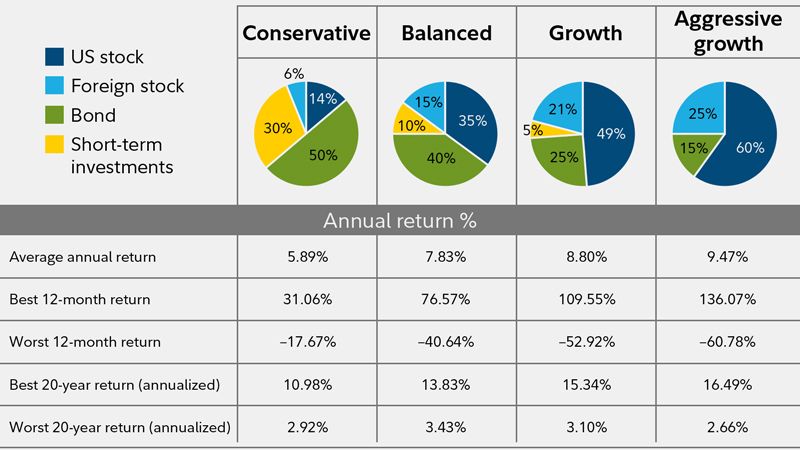

To start, you need to make sure your asset mix (e.g., stocks, bonds, and short-term investments) are aligned to your investment time frame, financial needs, and comfort with volatility. The sample asset mixes below combine various amounts of stock, bond, and short-term investments to illustrate different levels of risk and return potential.

**Past performance is no guarantee of future results**

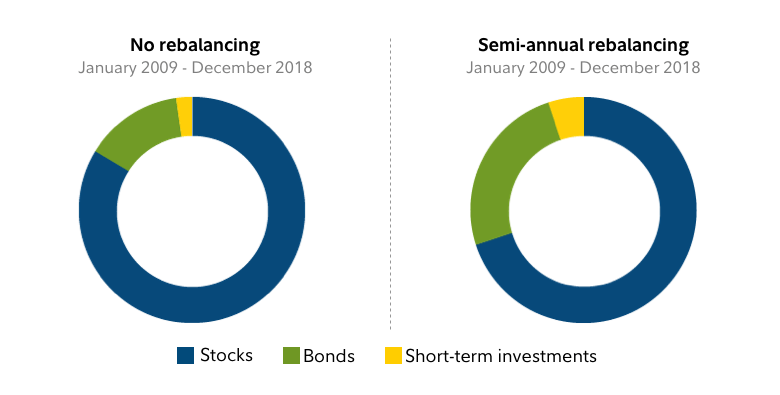

Once you have a target mix, you need to keep it on track with periodic checkups and re-balancing. If you don't re-balance, a good run in stocks could leave your portfolio with a risk level that is inconsistent with your goal and strategy.What if you don't re-balance? The hypothetical portfolio shows what would have happened if you didn’t re-balance a portfolio from 2006–2019: The stock allocation would have grown dramatically (see chart).

**Past performance is no guarantee of future results**

The resulting increased weight in stocks meant the portfolio had more potential risk at the end of 2019. Why? Because while past performance does not guarantee future results, stocks have historically had larger price swings than bonds or cash. This means that when a portfolio skews toward stocks, it has the potential for bigger ups and downs.Re-balancing is not just a volatility-reducing exercise. The goal is to reset your asset mix to bring it back to an appropriate risk level for you. Sometimes that means reducing risk by increasing the portion of a portfolio in more conservative options, but other times it means adding more risk to get back to your target mix.